Enerstream Capital

Enerstream Capital

Enerstream

Scroll to Discover

Scroll to Discover

Overview

Energy powers the world. Enerstream Capital Partners II is a Dallas, Texas based private investment firm that focuses on energy-related investments. Our core focus is investing in proven and innovative companies seeking either growth or rebuilding capital. We strive to collaborate with existing management teams and founders with an aim for mutually beneficial results.

Deal access is driven by an Executive Team and Board of Directors with a valuable relationship network and decades of experience in the energy space. Efforts are driven by a talented, experienced, and energetic team. We aim to bring business sophistication, a valuable relationship network and discipline to our investments/portfolio companies.

Our approach to investing in successful companies is one of patience, focus and flexibility.

Investment Focus

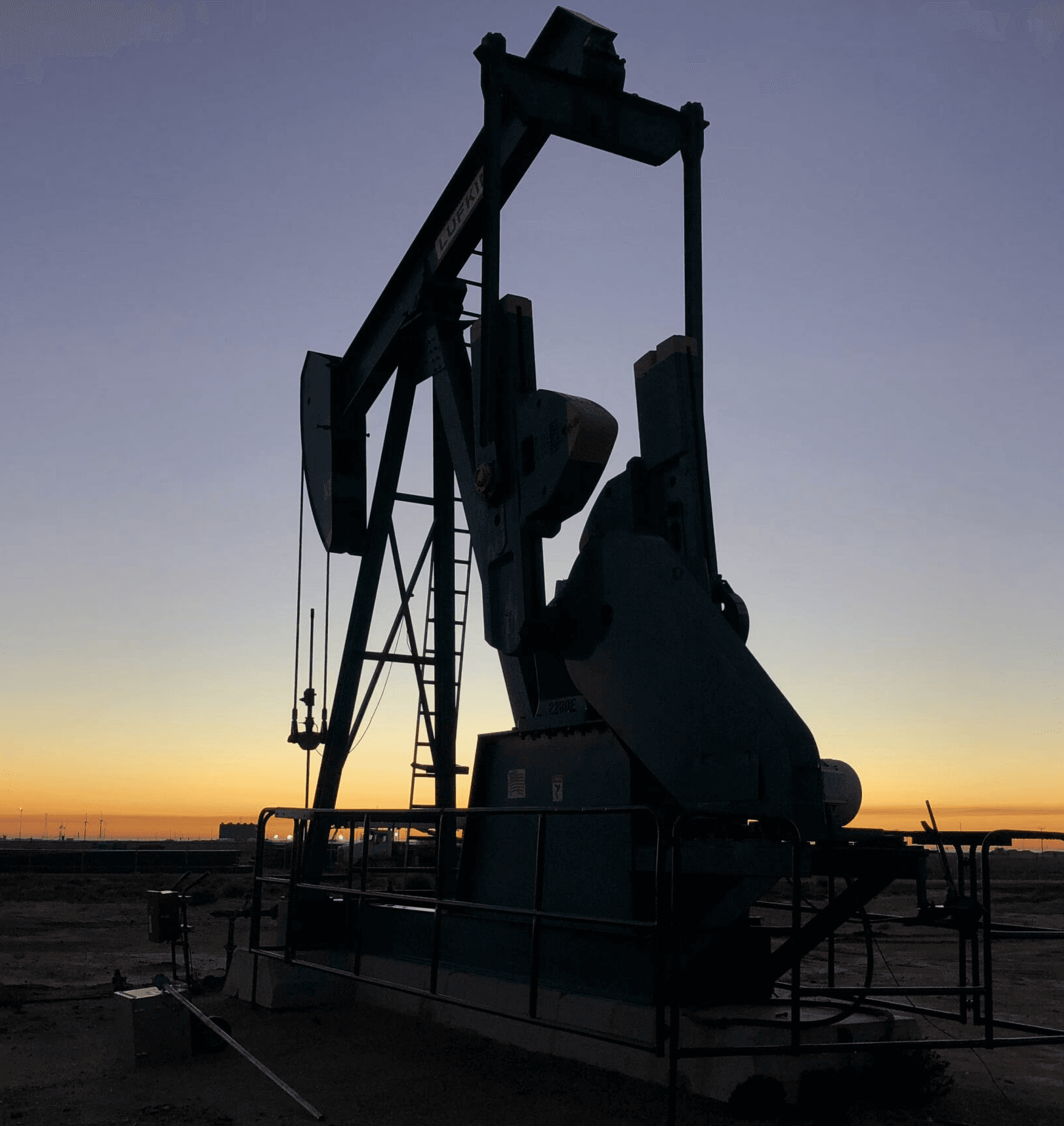

Upstream

Producing assets (OP and Non-OP), Technologies and Services

Our firm targets Producing assets and Solutions that streamline operations, improve resource exploration and extraction, and support growth and overall productivity.

Upstream

Producing assets (OP and Non-OP), Technologies and Services

Our firm targets Producing assets and Solutions that streamline operations, improve resource exploration and extraction, and support growth and overall productivity.

MIDSTREAM

Infrastructure Assets and Capabilities

Our Focus is on Assets and Capabilities crucial for present and long-term transportation, storage and delivery of energy resources.

MIDSTREAM

Infrastructure Assets and Capabilities

Our Focus is on Assets and Capabilities crucial for present and long-term transportation, storage and delivery of energy resources.

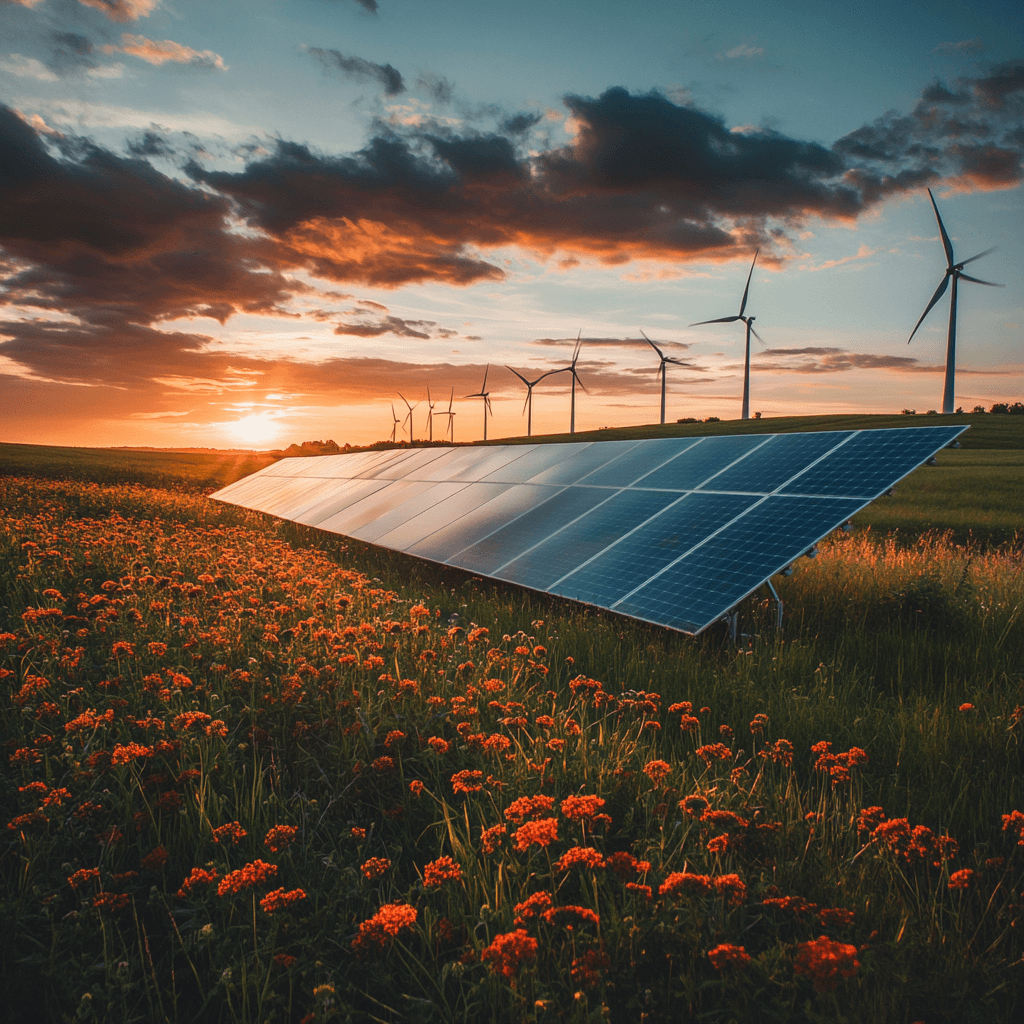

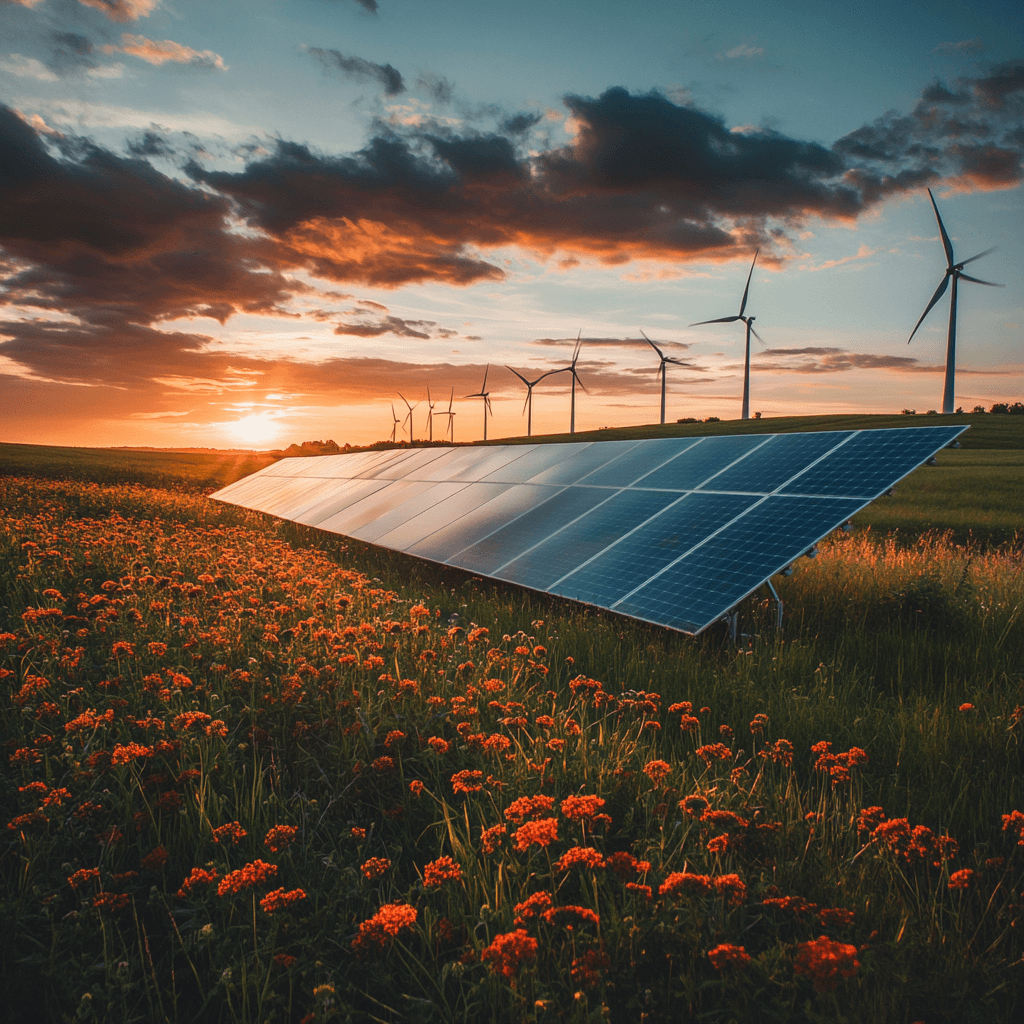

Alternative Energy and Unique and Supportive Capabilities

We explore Alternative Energy opportunities and Capabilities to diversify and advance our Energy portfolio. By investing in both traditional and emerging energy sectors, we aim to support long-term growth and contribute to a balanced and sustainable energy future.

Alternative Energy and Unique and Supportive Capabilities

We explore Alternative Energy opportunities and Capabilities to diversify and advance our Energy portfolio. By investing in both traditional and emerging energy sectors, we aim to support long-term growth and contribute to a balanced and sustainable energy future.

Investment Criteria

Areas of Expertise

Upstream Services and Technologies, Midstream infrastructure assets, select E&P and alternative energy opportunities.

Areas of Expertise

Upstream Services and Technologies, Midstream infrastructure assets, select E&P and alternative energy opportunities.

Areas of Expertise

Upstream Services and Technologies, Midstream infrastructure assets, select E&P and alternative energy opportunities.

Company Profile

EBITDA Range of up to $20M; partnering with existing management/founders with proven track records or innovative new technologies.

Company Profile

EBITDA Range of up to $20M; partnering with existing management/founders with proven track records or innovative new technologies.

Company Profile

EBITDA Range of up to $20M; partnering with existing management/founders with proven track records or innovative new technologies.

Investment Profile

Our typical capital investment per platform is up to $30M, or more as a co-investment opportunity; ability to layer in follow-on equity or debt capital over time with no mandatory time horizon. In addition to proven business models seeking growth capital, we invest in distressed opportunities.

Investment Profile

Our typical capital investment per platform is up to $30M, or more as a co-investment opportunity; ability to layer in follow-on equity or debt capital over time with no mandatory time horizon. In addition to proven business models seeking growth capital, we invest in distressed opportunities.

Investment Profile

Our typical capital investment per platform is up to $30M, or more as a co-investment opportunity; ability to layer in follow-on equity or debt capital over time with no mandatory time horizon. In addition to proven business models seeking growth capital, we invest in distressed opportunities.

Structuring

Flexibility to be made as direct equity investments, debt/equity hybrid models, new company capitalizations, carve outs or co-invests depending on circumstances.

Structuring

Flexibility to be made as direct equity investments, debt/equity hybrid models, new company capitalizations, carve outs or co-invests depending on circumstances.

Structuring

Flexibility to be made as direct equity investments, debt/equity hybrid models, new company capitalizations, carve outs or co-invests depending on circumstances.

Partnership

Initial business owner with a meaningful time and capital investment; shared governance; similar business values and vision for business.

Partnership

Initial business owner with a meaningful time and capital investment; shared governance; similar business values and vision for business.

Partnership

Initial business owner with a meaningful time and capital investment; shared governance; similar business values and vision for business.

Risk Mitigation

Contracted cash flow, financial and operational efficiencies and oversight; prudent use of leverage.

Risk Mitigation

Contracted cash flow, financial and operational efficiencies and oversight; prudent use of leverage.

Risk Mitigation

Contracted cash flow, financial and operational efficiencies and oversight; prudent use of leverage.

ENERSTREAM